Trading Software Development & Customization.

Modern trading firms and brokers rely on robust software to manage orders, risk, settlements, and market data in real time.

Overview

Trading software streamlines the entire lifecycle of trades: from order entry and execution to clearing, settlement, and post-trade analytics. It helps manage market data feeds, risk limits, compliance checks, and reporting, ensuring efficient operations in a fast-paced environment.

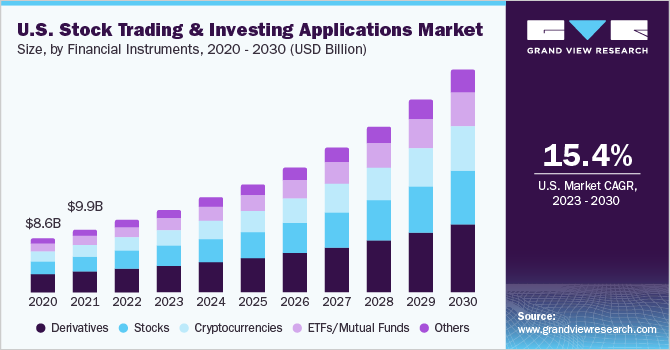

Software Demand in Trading

The trading industry demands low-latency order management, real-time market data integration, advanced analytics, algorithmic execution, and stringent risk controls. Firms need platforms that support multi-asset trading, connectivity to exchanges, automated workflows for compliance, and seamless integration with back-office systems.

CIS Solution for Trading

CIS Trading Suite offers end-to-end capabilities: order management system (OMS), execution management system (EMS), market data aggregation, risk management dashboards, compliance automation, settlement interfaces, and reporting modules. Its modular, scalable architecture ensures low latency, high throughput, and real-time visibility across all trading activities.

Advantage of choosing CIS